Creative Solutions for Water Quality Compliance

Why EcoLogix Group was engaged:

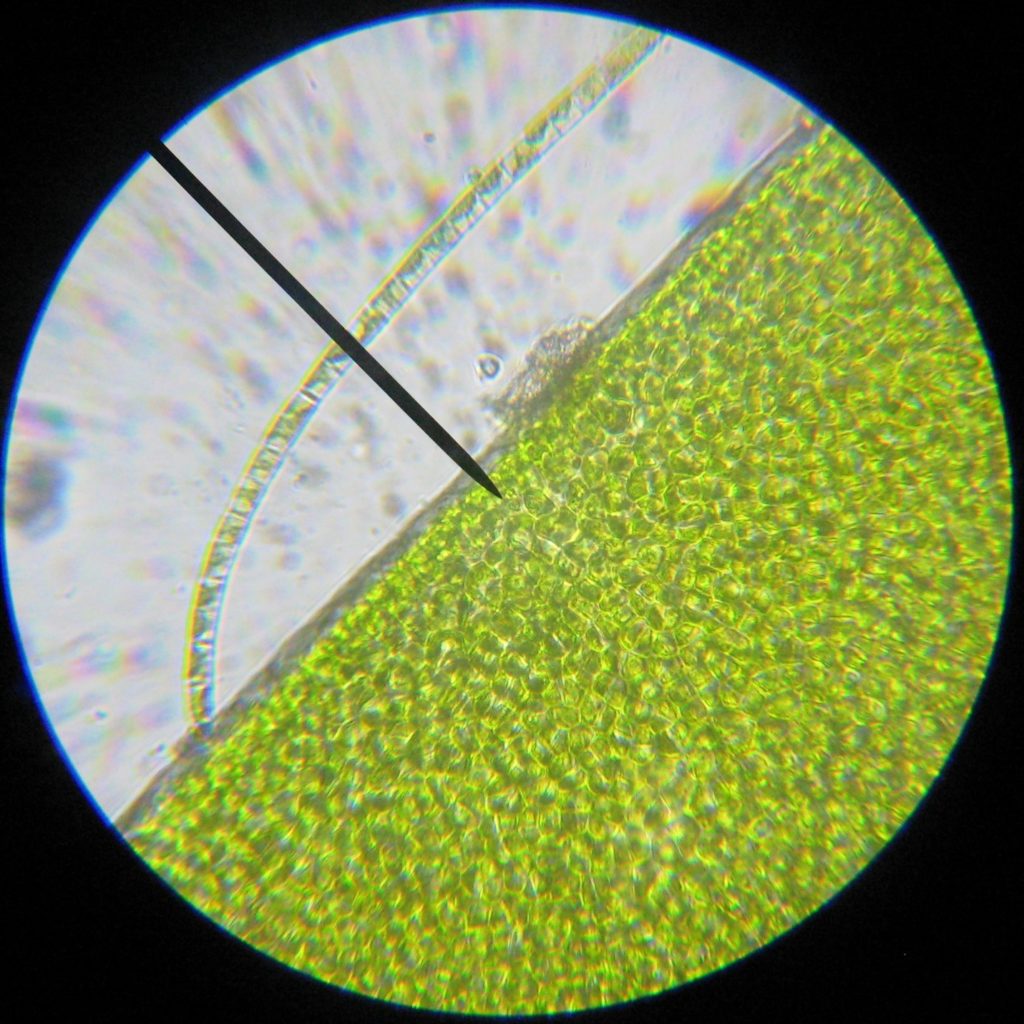

A seaport client has many environmental initiatives that are focused on meeting, and where possible exceeding, regulatory requirements. One area that is of particular interest is the use of innovative approaches for addressing stormwater requirements for the many acres of impervious surface on marine terminal facilities. EcoLogix Group was engaged to help obtain permits and regulatory approval for an innovative technology designed to grow algae using harbor water and remove the algae and associated nutrients to improve water quality in the harbor and meet nutrient reduction requirements for the water body. A pilot facility was constructed with funding assistance through a grant from an environmental non-governmental organization (NGO) and guided by scientists from a local university and a local environmental design firm. The facility is currently being operated on the client’s marine terminal in an unused part of the paved surface adjacent to the Harbor.

How EcoLogix Group responded:

EcoLogix Group was asked to assist the team because of its many years of experience with regulatory programs and its familiarity with the state nutrient trading program that is currently under development. Working with regulatory staff and the client’s team, EcoLogix Group has helped develop a new permit for the technology that includes provisions describing how nutrient credits derived from the technology can be generated and documented. Once fully operational, the credit certification process will allow permittees to meet their wastewater discharge and stormwater permit requirements using nutrient credits from a variety of management practices, such as this technology. The nutrient credit generation and trading program will be an important mechanism to help the state meet its nutrient reduction targets for the water body and other total maximum daily load (TMDL) requirements more efficiently and at lower cost.

Outcome:

EcoLogix Group is working with the team to pilot test the regulatory agency’s new web-based credit certification process, using the client’s pilot facility as a test case.

LEAD:

Robert M. Summers, Ph.D.